President Donald J. Trump announced the reinstatement of a 25% tariff on steel and aluminum imports on February 10, aimed at bolstering domestic metal industries, though it is likely to increase costs for manufacturers dependent on these materials. The decision, which revives a policy from his first term, removes previous exemptions and loopholes, applying the tariffs to imports from all countries. The president indicated that the steel tariffs are the first of many, with discussions underway regarding tariffs on autos, pharmaceuticals, and other goods.

The tariffs aim to protect American steel and aluminum producers from what the administration calls unfair trade practices and global overcapacity, especially from countries like China. However, these measures are expected to increase prices for industries that use steel and aluminum, including those involved in manufacturing machinery and equipment.

The effects of these tariffs are likely to be felt across various sectors, such as automotive and food packaging, which rely heavily on metal imports. Robert Budway, the president of the Can Manufacturers Institute, told the New York Times that the overly broad protections would harm them. “Tariffs and other broad trade tools can make America great again, but there are unintended consequences for our nation’s food security when a tariff is placed on tin-plate steel,” said Budway, whose association represents companies that make cans for fruits and vegetables.

The increased costs could lead to higher prices for end products and potentially reduce competitiveness in global markets. During President Trump's first term, similar tariffs resulted in higher metal prices, which benefited domestic producers but negatively affected broader economic sectors.

While the tariffs aim to strengthen national security by ensuring a robust domestic metal industry, they have sparked concerns among U.S. allies and industries that rely on imported metals. Countries such as Canada and Mexico, the leading suppliers of steel and aluminum to the U.S., may respond with retaliatory measures, further complicating trade relations. As of Feb. 11, neither country had commented on the tariffs.

The administration's decision to close existing loopholes and enforce strict standards on imports is part of a broader strategy to revitalize the domestic steel and aluminum industries. However, the potential for increased production costs poses challenges for manufacturers who must navigate these changes.

The broader economic implications of these tariffs extend beyond immediate cost increases. Industries that consume steel and aluminum might experience a contraction in production, as seen in previous years when similar tariffs were imposed. This contraction could lead to job losses in sectors that are already facing pressures from global competition and technological advancements. The ripple effect might also impact related industries, such as logistics and distribution, which support the manufacturing supply chain.

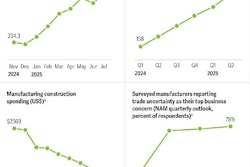

Companies may reconsider or delay capital expenditures on new machinery and infrastructure due to the increased cost of raw materials. This hesitation could slow down technological advancements and efficiency improvements that are crucial for maintaining a competitive edge in the global market. Additionally, firms might seek alternative sourcing strategies, potentially shifting supply chains to countries unaffected by the tariffs, which could have long-term implications for U.S. manufacturing.

The potential for retaliatory tariffs—such as those imposed by China when the administration enacted a blanket 10% tariff—adds another layer of complexity to the situation. Such measures could impact U.S. exports, creating additional challenges for manufacturers who depend on international markets. This scenario might prompt a reevaluation of trade strategies and partnerships, as companies strive to mitigate the risks associated with fluctuating trade policies. The uncertainty surrounding these developments could also affect market stability, influencing stock prices and investor confidence in the manufacturing sector. Ultimately, the tariffs may incite a shift in the competitive landscape, as domestic producers adjust to the new market conditions. Companies that can swiftly adapt by optimizing their supply chains and reducing dependency on imported metals may gain a competitive edge. This shift could lead to increased consolidation within the industry, as firms seek to leverage economies of scale and bolster their market position. The evolving dynamics also promote innovation in material science and alternative manufacturing processes, as companies investigate new ways to cut costs and improve efficiency.