PMMI’s Town Hall: Navigating Tariff Changes stressed patience, communication, and flexibility as packaging and processing machinery companies face uncertainty about President Trump’s tariff strategy. The tariffs, which as of March 5 include a 25% levy on goods from Mexico and Canada and 20% tariffs on Chinese imports, are expected to raise costs for imported parts and materials. This situation is prompting companies to reassess their supply chains and explore strategies to mitigate the financial impact.

The webinar, hosted by PMMI Vice President of Market Development Jorge Izquierdo, brought together trade expert and consultant Shawn Marie Jarosz, Founder and chief Trade Strategist of TradeMoves LLC, and two PMMI members: Alan Major, Chief Sales Officer of Urschel, and Claudia Silvie van den Pol, CEO and owner of Royal Apollo Group.

Jarosz detailed the constantly developing situation—so much so that she received updates on Canada’s retaliatory tariffs during the webinar. She outlined President Trump's America First Trade policy, which has led to increased tariffs on imports from China, Mexico, and Canada. She noted the potential for further tariffs on European imports and the retaliatory measures being considered by all affected countries.

Major and Van den Pol were willing to share their experiences with tariffs and offer opinions on how the current situation might play out. They repeatedly emphasized that open communication with customers and suppliers is crucial in this uncertain environment. They also discussed various strategies for mitigating tariff impacts with Jarosz, such as exploring multiple sourcing options, reviewing purchase agreements, and considering bonded warehouses to delay tariff payments.

Is the global economy at risk?

The panel was surprised right away when a survey of webinar attendees revealed that many companies in attendance had not felt an impact on their business yet. Van den Pol was particularly surprised, as Royal Apollo had been affected from the start of the year. She fears a completely unstable global economy if President Trump imposes tariffs on Europe, as he has threatened.

Major agreed, citing how Urschel has enjoyed a lot of success in Europe and China in the past few years and anticipates that slowing up due to tariffs.

“It’s just inevitable,” he said. “In China, I think our tariff level will probably approach 35% before the year is over, and that is almost unworkable to sell into because Asia, in general, is very price sensitive.”

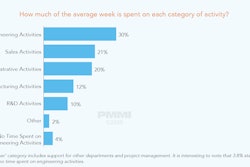

Uncertainty is paralyzing

“Businesses hate uncertainty,” Major said, “adding that uncertainty causes businesses to pause, which companies surveyed on the webinar agreed with. Attendees responded that their international customers admitted to pausing orders or withholding orders altogether, specifically because of the ambiguity around tariffs. Major’s biggest concern right now is that projects will dry up because both sides of the table “just have no idea how this is going to impact individual business.”

In the short term, he foresees situations where it might be necessary for OEMs to absorb costs caused by tariffs for the sake of maintaining customer relationships.

Remain nimble

To address these challenges, companies are focusing on flexibility and open communication. Some diversify their supply chains by sourcing from multiple regions to reduce dependency on any single market. This approach allows them to pivot quickly in response to changing tariff landscapes. Maintaining transparent communication with suppliers and customers is crucial to managing expectations and navigating cost-sharing arrangements.

Since this isn’t the industry’s first encounter with Trump-imposed tariffs, Van den Pol urged OEMs to be flexible in as many aspects of their business as possible. Royal Apollo is fortunate to have developed manufacturing facilities on three continents, which has aided its ability to mitigate supply chain costs.

“We are way more doing dual sourcing in different continents to make sure that whatever happens, whether it is tariffs or anything else that happens in the uncertain world that we live in right now, that we are covered,” she said.

Suppliers are advised to stay informed about tariff classifications on PMMI’s Global Trends blog, which is updated weekly with highly detailed input from Jarosz, providing specifics on each tariff’s impact and specific ways tariffs will impact packaging and processing machinery.