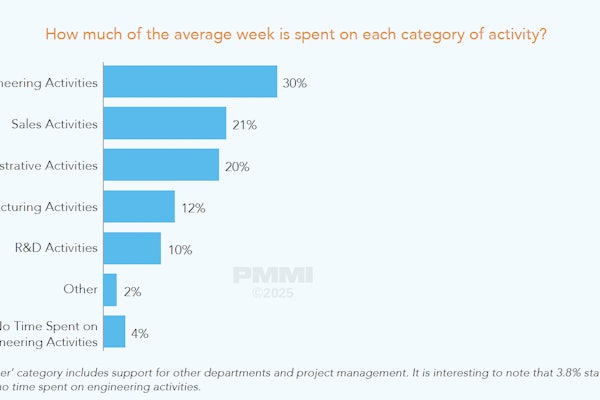

Much like their U.S. counterparts, Mexican CPG companies need new packaging machinery to check several boxes before pulling the trigger on an investment, according to PMMI Business Intelligence’s report, “Mexico’s Packaging Machinery Market Trends and Opportunities 2024-2025.”

Business Intelligence researchers surveyed 86 packaging and processing machinery users and interviewed 40 representatives from CPGs and relevant chambers and associations within Mexico’s food, beverage, personal care, pharmaceutical, and packaging industries for the report.

Price above all for packaging machinery

The researchers concluded that cash is king; surveyed companies say price is the primary factor influencing purchasing decisions when comparing packaging machinery alternatives. Price also ranks at the top in responses to the question, “In what areas can packaging machinery manufacturers improve?”

Mexico is a price-sensitive market, and packaging machinery investments are no exception. Price typically carries the most weight in investment decisions, especially for mid-sized and small companies. In larger corporations, return on investment or cost-benefit analysis is more important than machinery price per se.

In recent years, there has been increasing diversification in packaging machinery origins, particularly in secondary packaging equipment. A growing number of companies are considering purchasing Chinese machinery, although it still lags leading suppliers like Italy, Germany, and the U.S. Chinese penetration has shown a continued increase in market share over time, with competitive pricing being one of its main advantages.

Several CPGs interviewed also highlighted the need for financing options. With the reference interest rate in Mexico at 11%, it’s challenging to find feasible financing rates through local financial institutions. Countries like Italy, Spain, and China offer government-supported financing options, which have been particularly attractive when selecting suppliers.

Support after the sale

After price, post-sale service is the second most important factor in purchasing decisions. Local service offerings and capabilities are gaining importance among packaging machinery buyers, and the number of CPGs requiring local service on their RFPs continues to rise. Post-sale service, maintenance, and parts were frequently mentioned among the areas identified for improvement by CPGs.

Delivery times are another area for improvement, as several respondents indicated current average delivery times range from six to nine months, with some suppliers unwilling to commit to a specific timeframe. Some CPGs reported waiting more than a year for their machinery to be ready for delivery and had difficulty sourcing machinery from their usual suppliers due to excessive waiting times.

Flexibility was also mentioned as a key decision-making factor, with companies adopting SMED protocols and processes to reduce equipment changeover or setup times. Some companies undertaking modernization projects indicated they were replacing old machinery that didn’t meet their lean manufacturing protocols due to extensive changeover times.

Companies surveyed believe packaging machinery suppliers could improve by serving more as technical advisors and collaborating to find customized solutions for their unique packaging needs. CPGs also believe suppliers could assist in demonstrating the ROI or cost-benefit of their solutions and in developing more interactive maintenance, training, and demonstration materials using videos and e-learning tools.

SOURCE: PMMI Business Intelligence: Mexico’s Packaging Machinery Market Trends and Opportunities 2024-2025.

For more insights from PMMI’s Business Intelligence team, find reports, including “2024 Trends in Remote Services and Monitoring” and “2023 Sustainability and Technology: The Future of Packaging and Processing” at pmmi.org/business-intelligence.

Download the FREE executive summary below.