OEM Magazine rarely discusses politics but we will obviously cover policies and potential policies that will impact packaging and processing manufacturing.

In the coming weeks, the landscape of American manufacturing—including the packaging and processing sector—will confront numerous uncertainties, driven by a complex interplay of trade policies and labor dynamics. At the core of this shift is President-elect Donald Trump's ambitious plan to impose sweeping tariffs on imports, a strategy aimed at revitalizing domestic production. However, this approach encounters a significant challenge well-known to those in packaging and processing: a shortage of skilled labor to meet what could be a surge in factory jobs.

Trump's proposed tariffs, including a 25% duty on imports from Canada and Mexico and a 60% increase on Chinese products, aim to make foreign goods more expensive, thus encouraging companies to move production back to the U.S. An overlooked aspect of this vision is complicated by the reality that many manufacturing positions remain unfilled. Recent data shows that around 450,000 manufacturing jobs are unfilled, underscoring the ongoing labor gap.

The National Association of Manufacturers (NAM) emphasizes that 60% of its members consider hiring and retaining employees their top concern, even before the proposed tariffs. This issue is set to escalate, with forecasts predicting a need for an additional 3.8 million workers in the coming years. Factors such as an aging workforce, increased industrial demand, and new government-backed semiconductors and green energy initiatives contribute to this impending need. Additionally, with reshoring and the potential effects of Trump's immigration policies—which target the deportation of undocumented workers and restrictions on legal immigration—these measures could further diminish the available workforce, worsening the challenges packaging and processing manufacturers encounter.

Educating the nextgen workforce

Efforts to address the labor gap have included initiatives by manufacturing businesses and trade groups to attract younger workers through paid training programs. These programs offer high school students the opportunity to earn journeyman's certificates, equipping them with valuable skills and often leading to employment. Despite these efforts, the perception of manufacturing jobs as undesirable persists, with many young people deterred by the demanding schedules and the allure of more flexible work arrangements in other sectors.

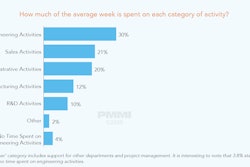

The educational system's role in addressing the labor shortage cannot be overlooked. There is a growing call for educational institutions to align more closely with industry needs, emphasizing vocational training and STEM education. For example, PMMI’s PMMI U elevates the talent level within the entire industry through cost-effective, convenient training and development opportunities and by connecting employers to the next-generation workforce. By fostering partnerships between schools and manufacturers, PMMI sees the potential to create a pipeline of skilled workers ready to meet the demands of modern manufacturing. A nationwide approach could help dispel outdated perceptions of factory work and highlight the opportunities for innovation and advancement within the sector.

Automation to the rescue?

The potential for automation to address some labor shortages is being explored. While automation can boost efficiency and decrease reliance on human labor in specific areas, it also necessitates a workforce skilled in operating and maintaining advanced machinery. This transition calls for training programs that provide workers with the technical skills essential for success in increasingly automated environments. Companies investing in automation must balance these innovations with the need to retain a human workforce capable of overseeing and complementing automated systems.

As manufacturing prepares for the potential impact of new tariffs, some companies are exploring strategies to ease what they anticipate as a financial burden. Some are renegotiating supplier contracts, reorganizing supply chains, and advocating for tariff exemptions. However, the long-term effects of these trade policies remain uncertain, particularly for those heavily reliant on imported materials.

The technology sector, for example, is subject to tariffs based on the foreign content and minerals in its products. Manufacturers reliant on imported metals, such as aluminum, zinc, and nickel, are especially vulnerable, given the limited domestic production of these materials.

The ripple effects of these tariffs reach beyond their immediate financial implications. They also pose a strategic challenge for companies that now need to reevaluate their global supply chains. Businesses are increasingly considering nearshoring options, which involve relocating production to neighboring countries like Mexico, potentially striking a balance between cost efficiency and reduced tariff exposure. This shift could redefine regional trade dynamics and alter the competitive landscape for U.S. manufacturers.