Global disruption due to COVID-19 has led to decreased capital spending throughout the worldwide economy, yet it has also been a catalyst accelerating the need for remote monitoring of industrial equipment. End users are looking for smarter ways to operate, and many machine builders and their suppliers are responding by pivoting business models.

For example, a shift from traditional purchase agreements to products-as-a-service (PaaS) provides more flexibility and opens doors for small-to-mid size manufacturers to acquire the resources they need to be successful. OEMs in partnership with software providers can offer value-added services to end users under this new paradigm, while generating predictable revenue streams.

MaaS and EaaS

Services are becoming an important pillar in the overall strategy for differentiation and revenue generation, and OEMs are responding by evaluating different methods for selling services or renting their machines. Instead of looking at the sale of a machine as the end of a transaction, OEMs are now concerning themselves with the entire lifecycle of the machine.

And as OEMs begin to offer their machines using new models such as machine-as-a-service (MaaS) or equipment-as-a-service (EaaS), software suppliers in partnership with OEMs need to license their software—and other advanced services such as machine predictive maintenance and remote health monitoring—in a similar way. At this time, only a small fraction of OEMs are offering these models, but competitive pressures should increase adoption rapidly over the coming years.

MaaS is where an OEM engages with a software supplier to access real-time and historical data from their equipment in the field. With this data, the OEM can offer value-added services such as guaranteed performance/uptime, advanced analytics for optimization, and predictive maintenance modeling.

EaaS is similar, except the OEM uses production data made available by the software supplier to rent out the hardware and software to end user customers, charging them based on usage. As the end user realizes production from the machine, the OEM is compensated on a per unit basis, effectively renting the machine. This provides end users with a more flexible payment option and lowers their financial burden as costs are only incurred when the machine is up and running.

MaaS is a monthly service fee (or subscription fee) while EaaS is a per-unit charge. However, both models free end users to focus on their core strengths by shifting maintenance, repair and update burdens to the OEM and their software suppliers.

Read more about the pay-for-performance model in the article The Aftermarket Opportunity: oemgo.to/aftermarket

Industrial automation software as a key enabler

Software suppliers in the manufacturing space are working with OEMs to make these new business models possible by adjusting their business towards a data-driven, service-oriented approach—transforming the end user customer spend from CapEX to OpEx.

OEMs would traditionally need a stack of hardware, software, and networking elements to implement these types of solutions. This would require integrating programmable logic controllers (PLCs), human-machine interfaces (HMIs), supervisory control and data acquisition (SCADA) systems, network media, PCs for historians and analytical processing, internet connectivity, cloud computing, and more.

Fortunately, modern HMI/SCADA industrial automation software systems have greatly increased capabilities and are ideally positioned to support PaaS models. They are typically installed close to the field equipment and data, and they possess the computing resources and connectivity needed to process and transmit information. This type of software can be delivered to OEMs in a software-as-as-service (SaaS) format, mimicking the OEM’s arrangement with their customers.

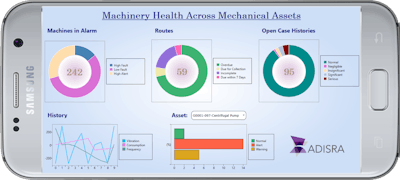

For instance, ADISRA SmartView is an HMI/SCADA package that can operate inside the OEM machine or any embedded edge device. It delivers traditional visualization functions, and also operates as a data collector and communicator to support other software products from the company for cloud-based advanced analytics and predictive maintenance.

New software licensing for intelligent machines

Software suppliers traditionally offered perpetual licenses suitable for when OEMs just sold their machines. Any subsequent support for ongoing updates and security patches, if it occurred at all, was a separate transaction, sometimes viewed by the OEM as a liability or an after thought.

New MaaS and EaaS models allow OEMs and their end user customers to keep software suppliers actively engaged, so everyone receives the benefit of the latest updates, while mitigating investment risk and reducing resource commitments.

For example, predictive maintenance is a key concept benefitting end users, OEMs, and software suppliers because:

- End users can directly link capital usage to production and equipment availability, clarifying the total cost of goods sold.

- OEMs can access digital data about how their equipment is used, what functions are essential, and operational costs—all in real-time.

- Software suppliers receive recurring revenue and performance data, both of which promote constantly improved software and predictive models.

The collection of data regarding the operation of the equipment, the volume of goods produced, and other production data required to implement modern operating models and predictive maintenance raises a data ownership challenge. The model thus relies on a true partnership among all parties, which requires data confidentiality agreements to ensure mutual success.

MaaS and EaaS advantage

Despite the data ownership issue, there is a real advantage during these turbulent economic times for OEMs to offer their equipment end users ways of reducing CapEx and moving expenses to OpEx. End users incur no OpEx unless OEM machines are producing product, while OEMs and their suppliers create recurring revenue streams, with all three parties prioritizing uptime.

And modern HMI software such as ADISRA can move beyond just visualization, adding the most needed historian, analytical, diagnostic, predictive, and remote connectivity features into an ecosystem enabled to run on a variety of hardware platforms at the edge. This feeds directly into these new equipment operating models, encouraging collaboration and knowledge sharing between all stakeholders, and allowing each to use their unique expertise to ensure optimal performance. This production-centric mindset aligns all parties for long-term success throughout the lifecycle of the machine.