This article originally appeared in Automation World, a PMMI Media Group publication.

By: Dave Greenfield, Automation World Editor-in-Chief

There is no shortage of people who love to share their thoughts on the direction of the economy. Most of those people are pundits. By definition, a pundit is an expert on the topic. But the term pundit has gradually become attached to anyone who thinks they know enough about a particular topic to speak publicly about it. Alan Beaulieu, president of ITR Economics, is not a pundit of that stripe. He’s an economist—and a funny one at that.

I’ve seen Beaulieu speak twice at industry events in the past couple of months, most recently at the Control System Integrators Association (CSIA) event in San Francisco, and he’s offering some solid advice to industrial companies. That advice is: Take advantage of the coming economic downturn to invest in your business.

You heard that right—economic downturn.

Despite the seemingly positive direction of the economy today, Beaulieu is confident a downturn is headed our way based on a number of economic indicators. The good news is that this downturn, which he expects to start in late 2018 or early 2019, will reverse by 2020 and lead to a nearly decade-long economic upswing.

What Beaulieu expects to happen in the late 2020s is not at all heartening. Think Great Depression 2. But that’s then and this is now. Which is why he’s strongly suggesting businesses take advantage of the coming slowdown to prepare for the upswing in 2020 and much of the following decade.

Beaulieu stresses that his predictions are not based on politics or policies, but rather mathematical models. Having seen him speak many times over the years, during different presidential administrations, he often points out that presidents have little impact on the economy. And the math he bases his predictions on doesn't lie. In fact, he’s taken to beginning his presentations by showing the high success rates of his math-based predictions over the past two years. His lowest performing predictions are in the 96% range.

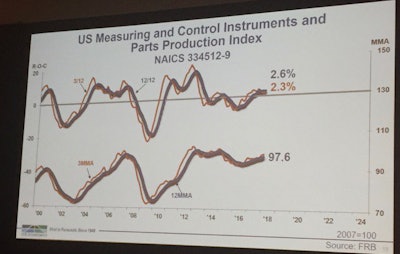

Which brings us back to the coming downturn. Nearly all the leading economic indicators Beaulieu tracks are turning down for the U.S. For example, year-over-year industry growth rates (which Beaulieu tracks in three-month and 12-month monthly moving averages) have been slowing since 2017. He expects the year-over-year growth rate for the U.S. economy in 2018 to be 2.9 percent. In 2019, however, it will turn negative with a -1.2 percent growth rate coupled with a slightly negative trend in capex. But in 2020, he expects the U.S. economy to bounce back to a 2.3 percent growth rate.

The only indicator tracked by Beaulieu that doesn't portend this downturn is the total industry capacity utilization rate. This indicator is showing a potential for increase in 2019. However, since all his other indicators show a downward trend, the capacity utilization rate indicator doesn’t sway Beaulieu’s opinion of the overall economic direction.

He also suggests that businesses not expect any positive effects from the recent tax overhaul to affect the downward trending indicators. “The economy is more complex than just tax rates,” Beaulieu said. In other words, the economy cannot be significantly affected by pulling just one lever. Plus, he notes that businesses had “more cash on hand than they knew what to do with before the tax change and weren’t investing it.” Therefore, he does not see how adding to the cash pile is unlikely to change corporate behaviors.

Beaulieu added that, if tax law does have an impact, it will show up in his capex tracking indicator. But so far, the trends are showing a decline coming here too. He notes that copper and oil and gas—leading indicators for capex—are all slowing.

Knowing that most companies will have a knee-jerk reaction to the 2019 downturn and limit or deny approvals for most projects, Beaulieu says this provides all the more reasons for smart companies to be contrarian in their thinking and take this time to invest and prepare for the bounce-back.

When it comes to investing for the 2020 upswing, Beaulieu suggests not only hiring new engineers and operators, but also looking at new office space, new production methods, new ways to gain efficiencies, new software, new equipment and even new websites. This last point may seem trivial compared to the rest, but Beaulieu stresses its importance in attracting Millennials.

“Target your website for Millennials,” he said. “Impress them; they will not consider you seriously if you disappoint them electronically.”

Though contemplating the coming downturn is not exactly uplifting, Beaulieu reminded attendees at the CSIA conference that it will be short-lived. “There’s a nice decade coming; prepare for it during the downturn in 2019,” he said.