In December 2015, the Italian Trade Commission invited PP-OEM to northern Italy’s self-styled “packaging valley,” which runs from Bologna northwest toward Milan, to visit a spectrum of OEMs that may be consequential to the U.S. market. After much arm-twisting, I acquiesced and agreed to traipse around northern Italy on a fact-finding and reconnaissance mission.

In general, these OEMs already compete with their North American packaging and processing counterparts. While EasyPack is a new kid on the block and that’s reflected current American market penetration, it has designs on growth here. And Tetra Pak, Marchesini, and SACMI each already has a considerable U.S. footprint to match huge export percentages from Italy—add to that a desire to grow in the up-trending U.S. market, especially as some Asian markets temporarily plateau.

To use an imperfect automotive analogy, these machines are high-end speedsters. Shipping distance, aftermarket support, maintenance, service and, of course, price, have long stood in the way of many more American packagers owning their versions of sleek Italian roadsters. But as machine supply becomes more global and connectivity improves, will those factors continue to stand in the way?

Just as Ford has been forced to kick it into gear with new technology and design, U.S. OEM adoption of the latest controls and components is one way to sandbag against waning aftermarket and service barriers to Italian machines. Bear in mind, these Italian companies compete all over Europe, the Middle East, and in Asia in ways that non-exporting U.S. OEMs haven’t had to deal with. That constant competition has kept their competitive claws sharp. For instance, three out the four companies I visited are early adopters of linear motion and other technologies that may stand to improve packaging overall. The fourth is using a unique co-packing/machine sales approach to pay its fee to entry in the U.S.

The following brief and regional profiles should demonstrate the rising competitive tide in the robust European market. Hopefully, the intel within will help to lift North American OEM ships.

Marchesini: A bird’s eye view of the hyper-lean Pianoro facility.

OEM: Marchesini Group

At a glance:

Headquarters: Bologna, Italy

Facility visited: Headquarters, Pianoro (Bologna)

Founded: 1974

Market served: 85% pharmaceutical, 15% cosmetic

Annual revenue: $300 million (2015 turnover)

Percentage of business in exports: 87%

Specialty: Blister packs

U.S. sales: Marchesini USA, West Caldwell, N.J., 25,000-sq.-ft. facility.

U.S. prospects: Growing, especially in aseptic equipment, and track & trace. Major shares of its 89% export figure are in Europe (39%), China (13%) and Latin America (10%).

Visiting Marchesini Group, Bologna, was a clinic in lean manufacturing. Clean, orderly lanes and workstations, each with ample access to shared power, oils, fluids, pressurized air, and any other amenity, characterize each of the facilities several production bays. Stringing together incremental workstations allows for scalability with larger machine sizes.

The facility does not contain a machine shop or job shop. Located in this so-called “packaging valley” outside of Bologna, a fertile packaging machinery manufacturing area, Marchesini doesn’t have to go far to source the components and sub-assemblies that go into its equipment.

The headquarters building in Pianoro, Italy, was redesigned in 2014 to improve lane flow, incorporating a cellular-style manufacturing model. Now, the facility is laid out to include two cells for complete pharmaceutical packaging lines, two cells for stand-alone end of line machine assembly, a cell for liquid fillers and cappers, and a cell for sachet and stickpack machines, alongside logistics and operations facilities.

The facilities now feature an automatic storage system, with 1220 cells where sub-assemblies and preassemblies are kept at the ready. This system is entirely managed by PC and is ruled by an algorithm that finds the most efficient order in which to keep each cell stocked. This system augmented the 25 existing automatic vertical warehouses, where 3 million components are managed in inventory. Collectively, these PC-managed systems allow engineers to know, at any given moment, the location and availably of any given part, component, or subassembly.

As far as reputation, the company seems to fully embrace purpose-built, or integrated robotics. Instead of using freestanding robots available on the market to integrate into the machinery, Marchesini is known for building robot functionality directly into the machine, and then managing it via the standard machine software and HMI.

Marchesini: Engineers at work

Latest product lines

Founded in 1974, Marchesini entered the blister pack sector in 1987, and has made incremental speed improvements in packs per minute ever since its first forays.

The latest in blister line is 2015’s Integra 520V, which specializes in addressing markets—namely Asia and Latin America—where regulations only permit a one-blister per carton format. This machine produces as many as 520 blisters, and 500 cartons, per minute. Built on the Integra 320 platform, the new machine includes new pushers, a drum-type carton opener to deal with high speeds, and a new leaflet pick-and-place system.

From a new technology standpoint, the 520V is a departure from it’s previous editions in that it uses belts instead of chains for product and carton transports, and the mechanical cams have been replaced by linear servos for improved flexibility. This is just one example of the theme PP-OEM continually encountered: Italian OEMs are, at minimum, looking for ways to embrace the linear motion technology. Many are finding ways to incorporate it already.

Pre-filled syringes are another core competency for which the company expects growth. A new extension of its existing FSP 05 pre-filled syringe machine, the Extrafill edition is a filling and stoppering machine for nested syringes, developed to meet the growing pre-filled, disposable syringe demand. The machine is compact and flexible, and designed to accommodate from two to five stoppering stations to make it easier to manage work areas.

Extrafill can now run at 12,000 pieces per hour with precise batching operations, thanks to systems that center the syringes and completely protect them during the filling phases, avoiding contamination and ensuring sterility.

Growth & U.S. prospects

The company is currently in growth mode, too, with a new, 97,000-sq.-ft. facility underway in nearby Carpi, Italy. The facility, scheduled for opening in October 2016, will be used exclusively for blister packaging machinery, and will be the largest thermoforming manufacturing center in Italy when production begins.

In another growth-minded move, Marchesini is swimming against the tide by opening a Moscow office. This operation is designed to quicken the technical and bureaucratic transaction times of machine sales and will assist with punctual and customized assistance service in what can be a difficult region for exporters. In an era when companies are leaving Russia due to political instability and red tape, this move is notable.

As for the U.S., the company does not sell through distribution. Instead, all sales for the U.S., Puerto Rico, and Canada go through Marchesini USA, which is headquartered in New Jersey. Roger Toll, executive VP of Marchesini Group USA, considers the U.S. to be a stable to growing market and a particularly interesting market for aseptic equipment, adherence to compliance hurdles, track & trace and serialization for anti-counterfeiting.

SACMI: Recently increased number of dedicated U.S. sales managers, and plans on a stronger presence in U.S. beverage, packaging shows.

OEM: SACMI

At a glance:

Headquarters: Imola (Bologna), Italy

Founded: 1919

Percentage of business in exports: 89%

Market served: Glass and plastic beverage industries (also, ceramics manufacturing)

Specialty: Bottling, closure and container manufacturing machines (not including ceramics specialties)

U.S. sales: Direct sales, but also include a web of agents covering the US market

U.S. prospects: Growing in the U.S. Recently increased the number of sales managers dedicated in the U.S., and planning on a stronger SACMI brand presence in beverage and packaging shows. Major growth areas include Africa, (both sub Saharan and North), India, and the Far East, while focusing on improving European market share for cappers and plastic preforms production.

Another impressive facility from a lean manufacturing and organizational perspective was SACMI. With an entirely engineered to order (ETO) production style, the company has internal machine shops manufacturing most of its machines’ components.

Like any OEM dealing in custom and engineered-to-order lines, SACMI takes a consultative approach toward clients. Iacopo Bianconcini, marketing manager, says that SACMI is the only company he knows of to deal in a full complement of beverage technologies; from plastic transformation to semi-finished products to blowing, filling, labeling, right up to end-of-line. “Our R&D and laboratory is central in this and can transfer to client a unique added value, able to understand client requirements and anticipating technological issues,” he says.

Facilities and technologies

Updates to the facility in 2014 included an expansion of the injection preform molding platform range, allowing for more flexibility in the preform production machinery portfolio for the beverage market, while enhancing the compression technology for caps and closures. In beverage closures and preforms, efforts and resources are concentrated both on developing closures and containers that are increasingly thinner with high performance, and on making the offer even more competitive by reducing cycle times.

Also, the company recently invested in expanding upgrading its 360° quality inspection and control systems. Solutions that were initially developed for controlling labeled containers were extended to other equipment on the packaging-beverage chain, from preforms to decorated metal caps. The company’s Cube Eye 3D X-ray inspection systems for caps-bottles also were extended into upstream and downstream machines.

SACMI: Assembly meetings on the floor at the Imola facility

Core competencies include the production of continuous compression molding (CCM) machines for plastic cap-production. During its 20 years in the flat top beverage cap market, the company claims to have earned about 50 percent of global market share with more than 1,500 machines worldwide, and about 80 in the U.S.

The company also specializes in compression blow forming (CBF) of containers. This is a unique thermoplastic material processing method, enabling a company to create a container directly from the granulated plastic material. The process is based on continuous extrusion of plastic materials, which are cut into pellets, put into an open mold, and preformed while being thermo-regulated to a temperature that allows for blow-forming inside a mold. Older extrusion blow molding, which created conical shapes instead of the smaller, blowable preforms, didn’t have near the dimensional tolerance of CBF technology, wherein plastic scrap is all but eliminated.

This facility also manufactures a cap preform buffer (CPB) machine, which SACMI believes is globally unique. It serves as a storage system for different colors, shapes and varieties of caps and preforms to reside in a sterile, contaminant-free environment. This eliminates the need for caps and preforms to be washed or sterilized in the time that elapses in storage/inventory, between when they are created (injection preform production and compression caps production) and when they are used (blowing and filling). This also allows for quick changeovers with inventory of different container and cap sizes, shapes and colors already on the line, awaiting a run.

Easysnap: Machine sales in U.S. could bolster co-packing model.

OEM: Easysnap

At a glance:

Headquarters: Modena, Italy

Facility visited: San Giovanni, Persiceto, Italy (Manufacturing facility, co-packing HQ)

Employees/service personnel: 40/7

Annual revenue: $5 to $10 million

Revenue reinvested into R&D: 30%

Percentage of business in exports: 95%

Market served: Liquid products predisposed to small/single serving sizes. Primarily food & cosmetic; some medical/pharmaceutical applications

Business model: Co-packing in Europe, with increased focus on co-packing and machine sales in global markets, especially the U.S. and Asia

Specialty: Snap-open sachet package hf/f/s-style machines

U.S. sales centers: New York, Memphis, Tenn. (also, Toronto)

U.S. business model: Grow machine sales into major market. Grow existing co-packing facility for food and medical devices. Work with new partner, Arcade Beauty, to introduce new cosmetic co-packing facility.

This relative newcomer mixes OEM, co-packer, and package designer into a multi-pronged business model, widening the growing unit dose, sachet style market currently occupied by Tapemark, St. Paul, Minn., among others. Easysnap’s area sales managers divide sales efforts either into the co-packing business area or into individual machine sales business area. In the U.S., sales for both arenas are based in New York and Memphis.

The company’s strongest markets are in liquid foods, like salad oil, water flavoring packets, or on-the-go (extreme sport) unit meals or unit energy boost packets. It also sees strong potential to gain market share wherever sachets currently overlap with single dose cosmetics, like sunscreen, hand sanitizer, or fragrance. It aims to maintain and grow its co-packing business in its European backyard, but aims to grow both co-packing and individual machine unit sales in the U.S. and Asia, where specialty product packagers produce requisite volumes of sachets to necessitate a single dedicated machine.

Easysnap: Andrea Taglini explains the machine behind his company’s snap/sachet package design.

Structural packaging technology

Easysnap’s sachet-reminiscent single dose packages for liquid and semi-dense product use a unique opening system. When a consumer bends the package by more than 90°, a mechanically made center cut (patented) breaks open progressively, according to the amount of pressure exerted. This allows the product to flow out in a manner that is completely controlled by the consumer.

The package can be opened using one hand only and dispenses the product quickly and cleanly. This concept offers versatility, marketability, and a fresh design for the food, cosmetics and pharma industries. Also, the structure is able to substitute for current conventional mono-dose packaging designs, including the 3- or 4-sided seal sachets, tubes, small bottles and thermoformed cups and bowls.

The machine itself

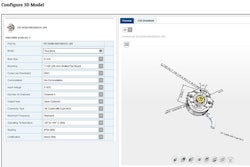

The latest version of the evolving pouch packing machine is the Easysnap STAR Plus. The automation platforms are PAC-based, and feature B&R Panel PC HMI, Bosch Rexroth and B&R servo and motion control, Bosch Rexroth brushless motors (seven drive the entire machine), heat transfer printing, and a machine safety platform.

This machine can run at speeds as fast as 240 mono-dose units per minute, thanks to a patented 6 lane variable micrometric pre-set cut group. The machine now features ER- compatible software, and modems for PLC remote support. Filling/dosing unit accuracy is within 3 percent, at as much as 30 mL fills per unit.

Tetra Pak: The Modena, Italy facility concentrates on machine R&D.

One area of particular interest for the company is linear motion.

OEM: Tetra Pak

Tetra Pak a glance:

Headquarters: Pully (Lausanne), Switzerland

Facility visited: R&D facilities, Modena, Italy

Founded: 1952 (first machine ships – material concept predates machine)

Markets served: Beverage, specializing in shelf-stability in dairy, juices, etc.

Annual revenue: $2 billion in capital equipment sales (2013)

Percentage of business in exports: N/a, multinational

U.S. headquarters: Denton, Texas

U.S. market prospects: Historically, U.S. penetration has been limited due to the fact that what put Tetra Pak on the map doesn’t necessarily resonate in the U.S. market; namely, shelf-stable, non-temperature sensitive milk delivery. Tetra Pak’s Tetra Top package design is making a splash entry into the U.S. market with September 2015’s launch of JUST Water.

Tetra Pak doesn’t require much of an introduction. As much a material and packaging system provider as a pure OEM, this major player isn’t a home-grown Italian company. The Modena, Italy facility that PP-OEM visited focuses on machine R&D, and one area of particular interest in the massive facility was an entire section devoted to experimenting with linear motion. According to Davide Borghi, technology specialist in mechatronics, motion control, and condition monitoring at Tetra Pak, implementing new linear motion technologies is a major focus area for R&D efforts at this facility.

Tetra Pak: The company claims its A3/Speed machine gives the fastest package output in the industry.

Trickling into the U.S. market

While consistently growing, and no stranger to the U.S., Tetra Pak hasn’t had the kind of market penetration here that it has enjoyed elsewhere globally. In part, this is due to its specialty in shelf-stable dairy and juice. Tetra Pak aseptic sealing systems, and laminated package wall material structure, prevent spoilage and allow for shelf stability in these product categories, even at room temperatures. Still, Americans just never had much of a palate for room temperature beverages; especially dairy products. These perceptions and regional taste profiles have been difficult nuts to crack for Tetra Pak in the U.S.

That said, a recent entry into the North American market, JUST Water, has been gaining consumer traction. The Glens Falls, N.Y., startup spring water purveyor has opted to be the first in the U.S. to use Tetra Pak’s Tetra Top® paper-based “carton bottle.” The package comprises a square carton body made from 53 percent paper, a bottle top constructed of high-density polyethylene, and an HDPE cap. The bottle appeals to consumers in that it is 100 percent recyclable.

Volume water-ready machines

Currently, the Tetra Pak TT/3 XH are used to produce Tetra Top bottles that carry JUST Water. When PP-OEM visited the Modena, Italy facility, a similar system—the latest A3 system—was being tested and manufactured. The A3 system uses the familiar Tetra Pak jaw system, which can be versioned for more flexible or more speed-oriented systems. A unique chain-driven jaw system means that the machine's roll-fed packaging material is formed into packages in continuous motion, making this—according to the company—the fastest carton package filling in the world at 24,000 packages per hour, or 7 per second. An induction-based power transfer means there is no need for connected parts, which limits wear and tear.

With the speed of these types of continuous machines, the volume coming off of them can be daunting. Upstream feeding and downstream conveyance and material handling could be limiting factors to overall speed. Perhaps this is where linear motion capabilities could shine for these volume systems.

Scared?

You shouldn’t be, at least not if you’re keeping up with the tech and keeping continuous improvement top of mind. North American OEMs have long enjoyed local preference, plus a distance and aftermarket support firewall that has held most foreign machine builders at bay. But now, machine end-users are more global than ever. While American OEMs may not have had to go head-to-head against foreign competition in the past, those old barriers are eroding. These four Italian OEMs are just a few examples of what North American OEMs may be up against. Hopefully, the intel contained in this report will serve as a motivator to shift into gear with technology. If and when a once-sheltered OEM finds itself in competition with foreign OEMs, especially those battle-tested machine builders from Europe, it’s best for the technological arsenal to already be in place.