Industrial automation OEMs may have a small window of opportunity before trade tensions between China and the U.S. continue to pressure the supply chain. Per the "Why Another Supply Chain Crunch Could Be on the Horizon for Automation OEMs" report, automation OEMs should act now to assess exposure, strengthen supplier networks, and ensure resilience before demand ramps back up.

Here are five reasons why.

1. A rebound is coming—but it could get complicated.

After a year of hesitation driven by shifting U.S. trade policy, many automation OEMs are anticipating a surge of delayed orders in early 2026. Lower interest rates through the end of 2025 are expected to fuel this rebound, potentially turning “wait-and-see” into “ready-to-order.”

2. China’s rare earth restrictions could stress supply chains again.

In October, China tightened export restrictions on rare earth materials—critical ingredients for many automation components, especially permanent magnet motors (PMMs) used in robotics and motion control. Manufacturers must apply for export approval now, raising the risk of shortages just as demand begins to climb.

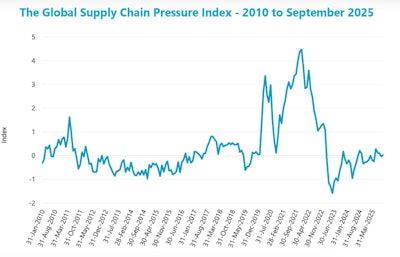

3. Lessons from 2021 still apply.

The last major supply chain crunch—sparked by post-COVID demand in 2021—left lasting effects. Over-ordering, long lead times, and inflated inventories took years to normalize. Many component vendors saw double-digit sales declines in 2024–2025 as customers worked through excess stock. Now that inventories are stabilizing, new stressors could emerge in 2026.

4. The next shortage will likely be narrower—but still disruptive.

Unlike the broad shortages of 2021, potential 2026 disruptions will mostly affect products reliant on rare earth materials. Demand is unlikely to reach 2021 highs, but even moderate constraints on magnets or related components could slow production for key automation products.

5. Lead times will determine winners and losers.

If rare earth shortages coincide with surging orders, supply chain preparedness will define competitive advantage. OEMs with diversified sourcing strategies and strong supplier relationships will capture market share, while those caught short on inventory could face delays and lost business.