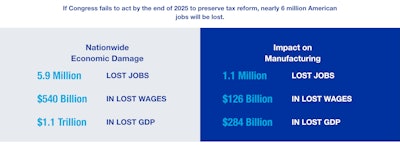

A recent study by Ernst & Young for the National Association of Manufacturers (NAM) underscores the potential economic consequences if Congress fails to renew key tax provisions from the 2017 Tax Cuts and Jobs Act. The study projects that nearly 6 million jobs could be lost, with the manufacturing sector facing significant challenges.

The study highlights that the expiration of these tax provisions could result in a $1.1 trillion reduction in U.S. GDP and a loss of approximately $540 billion in employee compensation. The manufacturing industry would bear a substantial portion of this impact, with over 1.1 million manufacturing jobs and $126 billion in wages at risk.

NAM President and CEO Jay Timmons emphasized the importance of the 2017 tax reforms, describing them as instrumental in enhancing the competitiveness of the U.S. economy on a global scale. He urged Congress to act swiftly to prevent economic setbacks and ensure continued growth in the manufacturing sector.

“The time to act is now. Millions of American workers are depending on the manufacturing sector to continue driving America forward,” said Timmons. “By acting now, policymakers can choose economic growth over economic disaster and protect American livelihoods. If Congress delays, manufacturers will be forced to delay investment and job creation decisions due to the uncertain outlook.”

In 2018, the first year after tax reform’s enactment, manufacturing experienced the best year for job creation in 21 years and the best year for wage growth in 15 years; similarly, manufacturing capital spending grew 4.5% and 5.7% in 2018 and 2019, respectively. Manufacturers have used the savings from tax reform to grow their businesses, create jobs, raise wages, add new benefits for employees, fund R&D, purchase new equipment, expand their facilities and invest in their communities.

House Speaker Mike Johnson and other industry leaders have echoed these concerns, stressing that Congress must prioritize renewing these tax provisions to safeguard American jobs and prevent wage decreases. Johnson & Johnson Executive Vice President Chief Technical Operations & Risk Officer and NAM Board Chair Kathy Wengel highlighted the role of manufacturers in driving economic growth and the necessity of maintaining competitive tax policies to support this momentum.

The study's findings suggest that the expiration of these provisions could have significant effects, not only on the manufacturing sector but also on the broader U.S. economy. As the deadline approaches, pressure mounts on Congress to address these issues and provide the necessary tax certainty for manufacturers to plan and invest in long-term projects.