At the 2025 FPA FlexForward Conference, trade attorney Meredith DeMent of Mowry & Grimson PLLC delivered a sobering update on trade volatility in the manufacturing sector: the tariff landscape has become as unpredictable as the markets it’s reshaping.

Even more uncertainty looms as the U.S. Supreme Court considers the legality of these tariffs. If the Court rules against the administration, companies may be eligible for refunds — but DeMent cautioned that any victory could be fleeting. “If IEEPA [International Emergency Economic Powers Act] tariffs are struck down,” she warned, “expect the administration to recreate them under other statutes that have already survived legal scrutiny.”

In short, tariff volatility isn’t going away — it’s being institutionalized.

Since returning to the White House, the Trump administration has implemented 15 active tariff actions under IEEPA. These measures, stacked atop standard duties and anti-dumping penalties, affect everything from steel and aluminum to machinery, paper, and flexible packaging materials.

DeMent noted that while these tariffs are framed as tools to leverage better trade terms, they’ve introduced layers of complexity that many manufacturers weren’t built to handle. “We’re in an era of unprecedented aggressive customs enforcement,” she told attendees, emphasizing that compliance failures are no longer tolerated — or overlooked.

Compliance becomes a core competency

For OEMs that depend on imported components, DeMent’s message was clear: build a compliance infrastructure now, or pay the price later.

Customs officials, she said, are adopting new levels of scrutiny — from verifying tariff classifications to tracking the country of smelt and cast for aluminum.

“I’m seeing Customs do things I’ve never seen in 15 years,” she noted. “If you don’t have an internal compliance program, you’re already behind.”

For machinery builders, this means more than just keeping accurate paperwork. It requires close coordination with suppliers, brokers, and trade counsel to ensure every entry — and every declaration — is defensible. Penalties for misclassification or origin errors can be steep, and with Section 232 tariffs on steel and aluminum hitting 50%, those mistakes compound fast.

In the crossfire

The economic and operational stakes extend far beyond legal compliance.

Higher tariffs on raw materials and machinery ripple through the manufacturing ecosystem, squeezing margins, delaying builds, and forcing companies to reprice projects midstream.

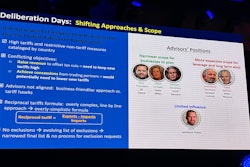

DeMent pointed to ongoing negotiations with Canada, Mexico, and China, where rates have seesawed between 10% and 45% in a matter of weeks. New reciprocal tariffs, meant to push trade balance with allies and rivals alike, add another layer of complexity. For EU imports, machinery rates now cap at 15% — but for Brazil and India, combined tariff rates can reach upwards of 50%.

Even U.S.-based OEMs that don’t import directly aren’t insulated. Rising costs across metals, components, and logistics have triggered price hikes throughout the supply chain.

“This is not a short-term challenge,” DeMent said. “Every manufacturer with cross-border inputs is now part of a tariff conversation, whether they like it or not.”

Adapting without overreacting

Despite the turbulence, DeMent cautioned against knee-jerk decisions like cutting long-term suppliers or reshoring too aggressively.

“With so much change happening so rapidly, you might choose not to abandon trusted suppliers just because of tariffs,” she advised. “These rates could shift again next quarter.”

That perspective reflects a growing pragmatism among OEMs — balancing flexibility with stability. Many are diversifying supplier bases across Southeast Asia while strengthening compliance documentation under the United States-Mexico-Canada Agreement (USMCA) and new bilateral agreements with Vietnam, Thailand, and Malaysia. These moves aren’t about escaping tariffs altogether — they’re about building resilience in a market where trade law has become a competitive variable.

What’s next

As manufacturers await the Supreme Court’s ruling, the broader trade picture remains murky. Even if importers win the refund battle, the White House has already hinted at expanding Section 301 and 232 actions to preserve leverage over trading partners. And if China fails to meet its commitments under the latest U.S. deal, suspended tariffs — including 100% duties on ship-to-shore cranes and cargo equipment — could roar back by 2026.

For OEMs, that means two things:

- Stay informed. Policy shifts are happening faster than product lifecycles.

- Stay prepared. Compliance, documentation, and supply chain agility are now strategic imperatives, not administrative details.

DeMent summed it up, “Tariffs are complicated, but ignorance is more expensive.”

In today’s trade environment, OEMs don’t just need engineers and salespeople; they need trade strategists.