The Deloitte 2026 Manufacturing Industry Outlook paints a picture of a sector diving into AI with both feet, all while continuing to juggle persistent challenges like labor shortages, trade disruptions, and uneven digital maturity. For OEMs, the coming year will be defined by investment acceleration, the rise of physical AI, and intense pressure to deliver smarter, more resilient equipment. Below are the ten most critical takeaways shaping the path to 2026.

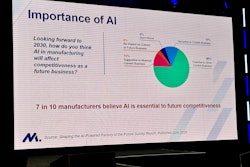

1. AI and smart manufacturing budgets are scaling up

More than 80% of manufacturers plan to put at least 20% of their improvement spending toward smart manufacturing technologies. OEMs should anticipate heightened demand for connected data-rich machinery with faster ROI expectations.

2. Physical AI moves into mainstream production

Robots, cobots, autonomous systems, and vision-enabled equipment are set to more than double in adoption by 2027. OEMs will face increasing expectations for machines that can perceive, make decisions, and act with minimal human oversight.

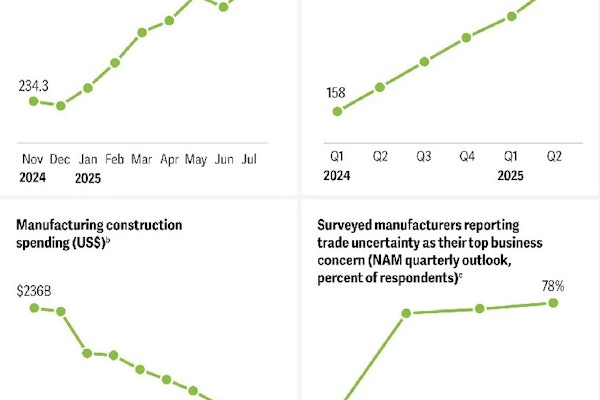

3. Tariff volatility accelerates AI-driven decision-making

Trade risk ranks as the top concern heading into 2026. Manufacturers are increasingly exploring agentic AI tools that simulate costs, evaluate suppliers, and map tariff exposure—shifting procurement discussions to deeper, data-backed modeling.

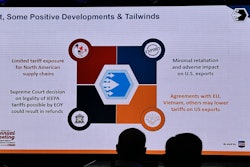

4. New trade agreements offer relief, but uncertainty prevails

Recent tariff reductions with the EU, UK, Japan, Korea, and Vietnam offer some stability. Yet the upcoming USMCA review and geopolitical frictions keep cost structures unpredictable, forcing OEMs to remain adaptable.

5. Investment surges powered by U.S. mega-projects

Federal incentives continue to fuel spending in semiconductors, data centers, and electrification. These expansions are generating downstream demand for processing, packaging, and handling equipment—an opportunity OEMs should aggressively target.

6. Reshoring momentum strengthens domestic demand

Manufacturers continue expanding U.S. operations to reduce lead times, mitigate trade risk, and capture incentives. OEMs should prepare for heightened expectations around local service, integration, and support.

7. Aftermarket becomes a profit multiplier

AI-enabled diagnostics, automated service workflows, and predictive maintenance are transforming aftermarket models. With margins outpacing equipment sales, OEMs that digitize support will gain a competitive edge.

8. Workforce shortages directly constrain modernization

A third of manufacturers rank upskilling as their top challenge. OEMs must design equipment that lowers operator skill requirements through intuitive interfaces, built-in guidance, and AI-assisted workflows.

9. “Build, buy, borrow” talent strategy

Manufacturers are blending internal development, external specialists, and contingent labor to keep projects moving. OEMs offering better training, documentation, and digital twins will support this shift.

10. Human-centered AI becomes the operating model

Despite rapid advances, more than 80% of task hours remain human-driven. The winning OEMs will be those who design machines that augment—not replace—operators with decision support, knowledge capture, and safer workflows.