Packaging and processing machinery OEMs tend to gravitate toward one of two poles: one-off custom engineered solutions, or volumes of standardized products, with plenty of gray area in between.

Though neither the dynamic nor the terminology has changed much in recent years, the center point on the continuum between engineered-to-order (ETO) and built-to-stock (BTS) is drifting towards custom, and away from standard. Many BTS lines are moving toward greater configurability and flexibility, so even among BTS manufacturers, the idea of ‘off-the-shelf’ no longer really applies.

Meanwhile, when it comes to fully ETO packaging and processing OEMs, the variables are too numerous to count, and there’s never a detailed roadmap to completion. The good news? It’s not most application engineers’ first rodeo with ETO.

Lean on experience with cost estimation, pricing

For ETO-focused OEMs, a strong database of previous jobs—how much they cost and how well they turned out—is invaluable, but such data won’t appear out of thin air. With 60 years of machine building history to draw upon, all-ETO Pearson Packaging Systems, Spokane, Wash., uses a database of “asbuilt” results, including comparisons between original budgets and actual costs for all machines shipped. Leo Robertson, COO, says that bills of materials (BOMs), models, and schematics provide detailed bases to draw upon when opening new custom projects.

At the ETO-heavy Massman Automation Designs, LLC, Villard, Minn., a similar system of “go-bys” (as in, “go by this drawing”) act as most recent common ancestors between existing and new ETO projects, and prevent applications engineers from truly starting from scratch.

Reliance on institutional knowledge in cost/price estimation means that dipping a toe into ETO can be difficult for an OEM that has recently hung out a shingle. The only way to deepen the pool of tribal knowledge within a team of engineers is through adding experience, either through wise hiring or cultivating expertise over time.

Even with a depth of experience, ETO means that cost estimates are not always on target. Duane Taillefer, VP, operations, Massman, describes a common situation in the proposal stage in which the applications engineers are able to narrow down a likely window of costs and pricing. The sales team then takes it to the customer where it will go through multiple changes. And once it becomes a signed order, engineers realize that the solution has changed.

“At that point, we have to change gears. Usually, in our initial design review, any disconnect becomes apparent. At that point, do we go back to the customer and tell them we need to do a modified proposal?” he asks. “We had a recent situation where we completely changed the scope of the machine and we issued the customer a massive refund because, given the changes, our solution didn’t need to be as complex, and we were able to simplify drastically. These things happen in the ETO world.”

When considering a completely new piece of equipment, Robertson agrees that most concepts can still be broken down into logical modules from which materials and labor costs may be derived by referencing previous experience. “The real challenges in price estimation are in concept generation and validation efforts,” Robertson says. “Normally, cost variances arise when the concept is revised. As an example, case packers are designed to condition and load various packaged products into final shipping containers. Frequently, product supplied for factory testing does not accurately represent the product we will need to actually process under plant conditions. The differences we encounter in the field may require design changes to the equipment. We do our best to anticipate product variation and to build flexibility into our designs, as we have to deliver a solution that works for the price we quoted.”

Farming out the fab for more flexible ETO

Conventional wisdom says that in-house metal fabrication affords more flexibility for custom parts, shortens timelines, and maintains precise control over part quality.

It’s true; homegrown fab is a model that works for many OEMs, and the majority of large ones. It wasn’t too long ago that Robertson was making a similar argument, but he’s singing a different tune now. Eight years ago, Pearson reassigned its 25,000-sq.-ft. fab shop to machine assembly space, eliminating it completely, and choosing to outsource components once made in-house.

“The flexibility to use an external, scalable fabricating and machining workforce gives us great lead time capabilities, and we can get parts just as fast as if we had made them in-house,” Robertson says.

Making parts on-site certainly allows an OEM to retain complete control, but it also can be a constraining factor from a capacity, fabrication technique, and materials availability standpoint. An OEM can only build what the OEM’s in-house tooling will allow, and often there can be limited square footage. In that sense, outsourcing components opens up Pearson engineers to more design freedom. As the company only does ETO, this is important. Plus, there were other, unintended consequences of the mentality shift that ended up working in Pearson’s favor.

“At the time we made the switch, which was in 2007, I was VP of engineering, so I was dealing with the process of cleaning up documentation,” he says. “When you’re making your components internally, it’s easy to take shortcuts in documentation—a guy who has run a mill for 20 years is going to have a knack for a finishing process that doesn’t appear on our documents.”

The move to outsource forced Pearson into far greater precision with process documentation. What was once left to tribal knowledge now relies on documentation that is so specific that it can be sent to any job shop in the country, with Robertson confident in expecting precise results.

“Internally, this was a big culture change, and not everyone was on board,” he says. “But now, I can ask anyone who was here at the time and resistant to the change about it, and they’d agree that it was the right decision.”

Pearson helped its transition from in-house to outsource by placing most of its fabricating workforce, and its fabricating machines (lasers, brakes, mills, etc.), in local shops. Many of the people who were making Pearson components in-house are still doing so, sometimes on the same machine. But now, there’s an inherent flexibility to potentially have a part made anywhere in the U.S. for faster service to a customer in need, thanks to improved documentation.

“Our core competencies are engineering, assembly, testing, and service. Fabrication was a supporting function,” Robertson says. “Now, people whose core competency is fabricating are making components for us, while we’re focusing on what we do best.”

Meanwhile, Massman follows a more typical model of in-house fabrication. Even so, the company isn’t married to the DIY approach. Depending on workload and backlog, Taillefer says Massman is completing about ¾ of the fabrication on site, acknowledging that they just don’t have the inhouse capabilities to tackle certain components.

“By staffing at about 75 percent of our need and volume, that also helps us weather the peaks and valleys that happen in a typical year,” Taillefer says. “This way, I can ensure that machine usage is optimal and every person is busy, no matter what time of year.”

He adds that he knows the Pearson model, and can see the benefits, but manufacturing isn’t one-size-fits-all. Situated in a rural area, job shops near Massman tend to be smaller and more specialized. Taillefer would have to split his work up among a dozen local job shops to fulfill orders, making logistics daunting.

Market-driven BTS vs. customer-driven ETO

The differences between ETO and BTS manufacturing are often boiled down to custom vs. standard, but it can be taken a step further by comparing marketdriven vs. customer-driven approaches to machine building. ETO work is often about making a single, usually large, customer happy. But BTS is about projecting the viability of a machine over the long haul, and spread over many customers.

With a market-driven approach, a lot of the engineering is front-loaded into a project. Conspicuously absent in this model is the foot-tapping, watch-checking customer hoping to take delivery before Christmas, or perform a Factory Acceptance Test next time they’re in town.

This affords a certain freedom, but it also carries risk; an OEM is betting that the market will be there. For standard, market-driven products, BTS (or Build to Order) products, risk is mitigated via due diligence. Strong market research and R&D help determine if a would-be standard product will sell at sufficient volume to warrant carrying inventory. But with shrinking product runs, and more frequent new SKUs in CPGs, even BTS manufacturers have to build in a certain amount of flexibility into their standard products. Now more than ever, flexibility comes by way of modularity and configurability.

“In order design and engineer a standard product line that can be manufactured quickly and efficiently it has to be more configurable than ever,” says Nicholas Taraborelli, Paxiom, Las Vegas, which showcases standard, but increasingly configurable packaging machines. Paxiom brands vary between ETO to BTS, but WeighPack, for instance, builds close to 90 percent BTS (but configurable) machines.

Meanwhile, when it comes to custom, ETO products, volume is also a consideration, albeit in a different form. The real ‘golden goose’ for ETO is finding those custom projects that cascade into repeat purchases, according to Taillefer.

“There’s a lot of trial and error in design and testing for an ETO machine. We don’t have the luxury of fully engineering everything, so we design it to 80 to 90 percent, then figure it out as we build it,” Taillefer says. “That’s why repeat orders are so valuable; you’ve gone through all the iterations of trial and error. We do very well on them, both margin wise and time wise. All those things that cost us money on the first machine, we already have figured out on the second or tenth.”

Lean where you can

Lean application specifics aren’t as easy to incorporate when it comes to custom work, but lean concepts certainly can be applied to ETO. For Robertson, front office activities, including, estimating, project management, and design engineering all offer opportunities to improve processes.

“On the assembly floor, we use many lean concepts that some might believe apply only to standard equipment configurations,” he says. “Simple things like making the right tools and materials easily accessible, neatly and consistently stored, can yield big benefits.”

Taillefer points to lean concepts and goals—specifically continuous improvement—as a means to control material exploitation and standardizing wherever possible within a non-standard engineering environment.

“Sourcing parts and materials has become easier in recent years, so it’s not as critical as it was in years past; just searching on a part number online, and I can get anything or any material I want,” he says. “That said, and more specific to raw materials, if your doing in-house fabrication, standardization becomes key. We are currently using 1,200 to 1,300 different raw materials in fabrication, different varieties of stainless, aluminum, etc. That’s a lot of different materials to maintain in inventory. It gives us flexibility, but if we can reduce those numbers over time, standardize where we can, it would benefit us greatly and we’ll continue to improve.”

Sheltered in ETO

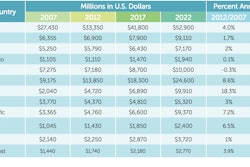

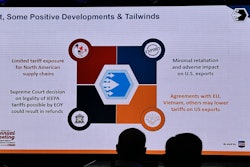

Research done by PMMI in times when OEMs were feeling heightened international competition pressure (Key Attributes of Packaging and Processing Machinery and Suppliers, PMMI Business Intelligence, 2012, Table 7-2), shows that ETO is, in particular, protected against international encroachment.

“While the world continues to get smaller from a communications standpoint, customers still need parts and physical support for their equipment,” Pearson’s Robertson says. “Our equipment is design for extended life expectancy. It is likely that our equipment will experience re-tooling, re-deployment or even a full rebuild during its lifecycle. Reasonable proximity to our installed base, definitely supports these activities.”

Massman’s Taillefer agrees, but says the dynamic cuts both ways. “In some regards, it keeps us from getting too international as well, because it’s a challenge to service in other countries, or design to their unique parameters,” he says.

Correctly deploying the troops

Most OEMs agree that a deft division of labor between ETO and BTS is essential. “We separate our engineering department into two sections. One is assigned to standard orders, and the other we call R&D and custom design. That ensures that we have always dedicated resources for custom design in our R&D,” Taraborelli says. “So when we are not managing certain custom projects for clients, those engineers’ time is spent in R&D, product development and product improvement.”

In Pearson’s ETO-only, design-engineering environment, sharing engineering resources between different levels of complexity isn’t an issue. Everything is highly complex. Robertson says the onus is on project engineers, with the help of machine ‘owners’ (subject matter experts), to assemble the proper design team for the project. Throughout the design process, project engineers extract additional knowledge that may reside in applications engineering (pre-sale), or any other recognized subject matter experts throughout the operations organization, including assembly and service. This is accomplished through multiple design reviews, both formal and adhoc. Broad and frequent participation, plus lots of feedback up and down the chain, is the key in this ETO-only environment.

Taillefer’s experience has been that it’s extremely difficult to succeed with a mixed mode that uses the same people within the same facility to accomplish both ETO and BTS tasks. He mentions the so-called ‘focus’ factory model, which was featured in the ARPAC article in PP-OEM’s summer issue (pp-oem.com/013), but successfully getting that up and running takes some doing.

“You can’t go into a Cadillac plant and ask them to do Chevys for a day, or vice versa,” he says. “It takes time to cultivate a team and a singular mindset, and it’s counterproductive to spread that too thin.

“Ultimately, finding and keeping the right people, in certain place, is imperative,” Taillefer says. “It’s key to have the right people, certainly in sales, assembly, and aftermarket. In, say, fabrication, it’s fine to outsource, but some of those other core competencies are experienced-based. If you lose a good person, it hurts. Bad.”